2026 Tax Preparation Fees – What It Costs to Get Your Taxes Done

Tax season is the holiday hangover we love to hate.

However, we have received one gift — technological advances have made it easier for people to prepare their own taxes and bypass expensive tax accountants.

Here is a rundown of tax-preparation software and tax-preparation services (including reviews and costs) to help you find the most effective method to file your taxes.

Tax-Preparation Options: Overview

Tax-preparation options range from paper forms to full tax-preparation services:

- DIY with paper forms, fillable forms, or e-filing sites, which are free to use

- Software or online subscription services

- Tax preparers

- Tax accountants

DIY Tax Prep Methods: Paper Forms, Fillable Forms, Efiling Sites

The advantage of DIY options is that they are free.

The disadvantage is that you have to know what you’re doing because most provide no help.

Free software and services are usually limited to those whose income doesn’t exceed a certain amount or whose tax return comprises only simple forms.

Some sites support more complex returns and are free. However, they harvest a lot of sensitive personal data (to sell in exchange for providing that free service).

Paid Software or Online Subscription Services

Tax preparation software and online subscription services offer more assistance.

Services and pricing vary widely. Some include wizards that offer a structured interview and input your answers into tax forms. Others allow you to view and work with the forms yourself.

Check the features carefully before committing: Some services let you get part way through your return and then tell you that you’ll need to upgrade to a more expensive version in order to finish. Some only determine the price at the time of print or e-file.

Tax Preparers

In-person tax preparers are great for those who don’t want to do the work themselves.

If you are not confident in your tax skills or don’t want to be bothered with preparing your own taxes, a tax preparer can save you some headaches.

Tax preparers, such as the seasonal ones hired at Liberty, H&R Block®, or Jackson Hewitt, complete a tax preparation course each year and pass a licensing exam (if required in your state). These firms also employ tax accountants with extensive experience and education to handle more complicated scenarios.

Tax Accountants

Tax accountants, including CPAs, can help you with tax planning.

Tax planning helps you minimize your future tax obligations. Planners can help you choose tax-sheltered investments, for example, or help you structure your debts to take advantage of tax laws. They can help self-employed individuals maximize their legal deductions.

Tax accountants also have the know-how to prepare complicated returns for businesses, corporations, partnerships, non-profits, and trusts.

Find the Best Savings Accounts for Your Tax Refund

If you’re lucky enough to get a tax refund, or if you want a good place to save money for the taxes you’ll owe next year, compare rates, fees, and more on savings accounts.

Free Online Tax-Prep Options

You can do your own taxes by picking up forms from your post office or library, filling them out, and mailing them in. But almost no one does this anymore because you can file online for nothing. No wasting time, gas, or postage.

VITA Program

If you’re eligible, you can actually get free tax assistance from a human preparer, courtesy of the Volunteer Income Tax Assistance (VITA) program offered by the IRS. Those whose income is $60,000 or less, have disabilities or have limited English-speaking ability can get free, basic income-tax-return preparation and electronic filing.

Many tax software companies offer free programs through the IRS Free File program.

Tax experts recommend accessing your program through the IRS website to avoid accidentally ending up in a different program. If your income is too high to qualify for free tax-preparation subscriptions, you can still access free, fillable tax forms.

Use the IRS Free File Software Lookup Tool to find free federal and state-return options. It eliminates services for which you’re not eligible. This is important because one of the biggest causes for complaints from consumers is that they started a free file and then were directed to pay for an upgrade to finish the return. Here are the free options.

Cash App Taxes

Cash App Taxes offers free filing for most situations with an interview-like interface. However, they collect “information that identifies you or individuals in your tax household personally, such as name, address, phone, social security number, and government-issued photo identification” for online marketing.

It’s $0 to file both state and federal tax returns, even if you’re taking deductions or credits.

eFile.com

The free service from eFile.com applies only to filers with income of $100,000 or less who take the standard deduction, have no dependents or retirement income, and don’t have more than $1,500 in interest income.

There is free customer support by email only, and it can take up to three days to hear back.

Etax.com

Etax.com features an interview-style preparation. The free service supports the most basic tax return for single or married taxpayers without dependents who also need to file a state tax return.

The free federal offer is a promotional discount for basic filers who are also filing a state tax return.

The website indicates that the purchase of a state return is required for the free version. Actual prices are determined at the time of print or e-file and are subject to change without notice.

ezTaxReturn.com

The service is an interview-style preparation that does not allow downloading, viewing, or printing of the actual tax forms. Reviewers give ezTaxReturn good marks for its simple interface.

FreeTaxUSA.com (Tax Hawk)

The free versions of FreeTaxUSA and Tax Hawk cover form 1040, 1040EZ, 1040A, 1040Z, Schedules A, B, C, D, E, EIC, and F, 1099-A, 1099-B, 1099-C, 1099-DIV, W-2, and self-employment income.

H&R Block

The free service offered by H&R Block applies to W-2 employees with dividend and interest income and no itemizing.

H&R Block also offers deluxe, premium, and self-employed paid versions for taxpayers with more complicated tax filing issues.

OLT OnLine Taxes

The free edition of OLT Online Taxes is limited to filers with an adjusted gross income of $41,000 or lower. Active military members must have an AGI of $73,000 or less.

Those who don’t qualify can still file their federal return for free and pay $7.95 for state returns. OLT gets 4.8 stars on average from online user reviews.

TaxAct

The free edition of TaxAct is for simple federal and state returns, filing with dependents, and students.

It’s free to prepare, print, and e-file. TaxAct has an overall 4.5-star rating from online user reviewers, while users of the free version give it a 4.8.

Tax Slayer

Tax Slayer‘s free edition is for “basic 1040” returns only and includes a free state return. Tax Slayer’s user reviews improved markedly since 2019, averaging 4.5 stars.

TurboTax

TurboTax‘s free edition handles simple returns with W-2 income and the standard deduction.

It does not cover itemized deductions, business or 1099-NEC income, stock sales, rental property income, or student loan interest deductions.

For more complicated returns, the next level up is $39.

Paid Software or Online-Subscription Services

While free tax programs might work for many people, you may prefer to purchase a tax preparation software product or use an online subscription service.

There are several reasons that a commercial product might be better for you:

- Your taxes are too complex for many free options

- You don’t want your private data collected

- The up-selling pop-ups and ads in free products can be annoying

- You don’t like the interface or bare-bones features of the free tax-prep versions

- You are filing multiple returns for other taxpayers

Even if you start with a free option, it is smart to see what the providers charge for their paid products.

You would want to know that in case your return needs a form not supported by the free version and you either must upgrade that product or start over.

In addition, you’ll want to consider the total cost of filing. Some free options charge nothing for the federal return, but more for the state return than other paid services charge to prepare and file both the state and federal return.

Here are the details for commercial software and online subscription service options:

1040.com

1040.com recently changed its offering so that all federal and state returns are $25, and everything is included. There are no price tiers.

If you want to pay for your return from your refund, there’s an extra $24.95 charge. You can also get audit assistance through Protection Plus for an additional cost of $29.95. Online user reviewers responded favorably to the new pricing, increasing its ratings from an average of 1.5 stars in 2019 to 4.7 stars in 2023.

1040Now

Technically, preparation of a federal return is free at 1040Now.com — until you efile your tax return. However, you can print your return and not pay for efiling. The reality for most users, however, is that it costs $19.95 for the federal return and $17.95 for the state return.

Reviewers give it one star and note that there is no error-checking.

eFile.com

It costs $25.00 for eFile’s Deluxe version, and it supports itemized deductions. For $35.00, business forms and complex returns are covered.

For $29.00, eFile offers unlimited state returns. That is a great deal for those who file in multiple states.

eSmart Tax

eSmartTax offers several editions from the Basic (1040 plus interest income) for $45.95, the Deluxe at $65.95 (Schedule C and most other forms) for small business owners, and the Premium at $85.95, which you’ll need if you write off a home office or need support for K-1 or rental income.

It’s offered by Liberty, and the editions look the same.

The program gets four stars from user reviews and competes with TurboTax in the full-service arena. Prices are slightly lower than TurboTax. State returns are $36.95.

eTax.com

The basic edition of eTax costs $19.95 for the simplest returns without dependents. Those who itemize deductions or have dependents will need the $29.95 Deluxe Edition; and only the $49.95 version supports investments, self-employment income, or AMT.

State returns cost $29.95, and filers can get a CPA review of their returns for $24.95.

You can deduct eTax’s fee for preparing and filing your tax return from your refund for an extra charge of $39.95.

ExpressTaxRefund.com

The full version of ExpressTaxRefund is $29.95 plus $20 for e-filing; state returns are $25, and e-filing the state return is $20.

Online user reviewers give the package 4.5 stars.

ezTaxReturn.com

This company offers free filing for simple returns and charges $29.95 for its full version and $19.95 for a state return. Prepare and e-file your federal and state tax return combined for $39.95 ($9.95 off the total price of $49.90). For an extra $39.95, ezTaxReturn.com will manage the process if you receive a notice from the IRS or become the subject of an audit.

ezTaxReturn.com doesn’t support all states or stock options sales, short sales or wash sales of stock, investment real estate property sales, or depreciation or depletion for self-employed.

FileYourTaxes.com

FileYourTaxes starts at $45.00 (plus $40.00 for state returns filed with the federal return). However, that fee may be just the beginning. There is a $45.00 charge for business and self-employed returns. Efiling is included in the fees.

FreeTaxUSA.com

FreeTaxUSA is owned by the highly rated Tax Hawk. All federal tax returns are free. State returns are $14.95. An upgrade to its Deluxe package with professional support is just $7.99.

Users give the company 4.5 stars in online reviews.

H&R Block

There are a lot of ways to work with H&R Block to prepare your taxes. Its software offerings range from the $19.95 Basic (simple returns only) to the Deluxe for homeowners and investors to the Premium at $79.95 for freelancers and rental property owners to the Premium and Business edition for everything else.

One nice thing about H&R Block is that even the basic plan allows itemized deductions. The basic and deluxe editions charge $39.95 for state returns (e-filing a state return costs $19.95 for each edition). But the more expensive editions come with one free state return preparation (e-filing the state return costs $19.95).

It’s considered one of the easiest programs to use and gets 4.3 stars from online reviewers.

H&R Block also prepares taxes in person at its many offices.

Along with its free tax preparation for those who qualify, H&R Block offers a full slate of options for online tax preparation if you want to do your own taxes.

Jackson Hewitt

Jackson Hewitt offers relatively little online support, so it might not be your best option if you’re not experienced in tax preparation.

Jackson Hewitt has a transparent pricing guarantee. You’ll pay no more than $25 when you file, or they will refund your tax prep fees, no matter how complicated your tax return is.

Liberty Tax

Online tax filing for a simple return (1040 with a Schedule B for interest income) costs $45.95, and a state return is $36.95. If you itemize, the deluxe edition for self-employed taxpayers is $65.95, and the premium edition for investors is $85.95.

Liberty Tax gets high marks for ease of use, but the lower-priced options are limited. Users give it four stars.

Liberty also offers remote filing, where you take snapshots of your documents and forms and send them to Liberty to have your return done by a tax professional, but no pricing information is available upfront.

OLT OnLine Taxes

OLT‘s premium edition’s rock-bottom price ($7.95 each for federal and some state returns) may appeal to those who don’t need a lot of guidance with their taxes.

Those who dislike interview formats may also like this. The interface supports most tax forms, and there is no up-selling.

OnlineTaxPros.com

OnlineTaxPros costs $19.95 for the standard version, but it does not include state returns. The deluxe version is $19.95, and the state return is $10.

It gets good ratings from business filers but just two stars from individual online reviewers. Note that their site is not secure.

RapidTax

The RapidTax Basic return package costs $14.95 for a federal return, $19.95 for a state return bundled with federal returns, and $34.95 for each additional state return. It supports single or married filing separately with no dependents and deductions, W-2 income, Form 1099-INT & 1099-DIV, 1099-R, Form 1099-G, and Earned Income Credit.

To file more complex returns, it’s $39.95 for the deluxe option with all forms and schedules. The premium version handles self-employment, rental income, capital gains, and Alternative Minimum Tax at $54.95. The platinum version is for partnerships, LLCs, corporations, estates, and trusts at $69.95.

TaxACT

The TaxACT Deluxe+ edition costs $24.95 for federal returns and $44.95 for state returns.

It supports filers with dependents and everything in their free edition such as child tax credit(s), Earned Income Credit, education expenses, and prior year import. Then it adds unemployment income, itemized deductions, mortgage interest, HSAs, and tax-specialist support (see the website for the complete list).

More complex returns will need the Premier+ edition ($34.95 for federal and $44.95 for state) or the Self-Employed+ edition ($64.95 for federal and $44.95 for state returns).

TaxACT uses an interview format and gets four stars from online reviewers. It’s a low-cost option that’s easy to use.

Tax Slayer

TaxSlayer gets high marks for its pricing and ease of use. Filers can choose to walk through their return with an interview format or jump straight to the forms they want.

The Classic version is just $19.95 and covers almost all tax situations, including self-employed and investors. State returns are $39.95

More expensive versions add support and professional help.

Consumers online give Tax Slayer four stars.

TurboTax

One advantage of TurboTax is that it still allows buyers to download the software (as opposed to a cloud-based subscription) or even purchase a CD. That’s nice for those who prepare multiple returns for other people. However, experienced filers may find the required interview format a little frustrating. You can’t just go to the form you want and fill it out.

But for those who wish to prepare their taxes in the cloud, TurboTax offers online tax preparation services, too.

Professional Tax Preparation

Professional tax preparation services vary by service and location. At the low end are services from chains like H&R Block, Jackson Hewitt, and others. These firms hire seasonal employees who make, on average, $15 to $22 an hour. Their training typically involves completing an annual class and passing an exam.

However, the companies are staffed by tax accountants, Enrolled Agents, CPAs, and tax attorneys to provide supervision and guidance.

Taxpayers can have their online or in-person taxes reviewed by these pros at an additional cost.

Tax accountants

Tax accountants, enrolled agents (who are federally certified and can represent taxpayers in tax court), and CPAs have advanced training for more complicated returns. And it costs more to have them complete your return.

Filing State Returns

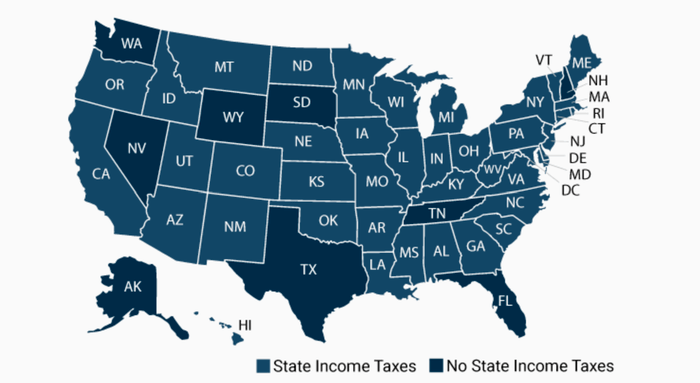

Filing taxes is obviously cheaper in states with no income tax.

Nearly all free tax programs charge for state tax preparation. When comparing free programs, look also at the cost of your state return.

Some paid software may be cheaper for a federal and state return combined than other free programs with more costly state fees.

If you derive income from more than one state that has an income tax, you’ll need to file a return for each of them.

If you moved in 2022, for instance, or have a rental in another state, you may have to file multiple state tax returns. If your business has clients or customers in other states, you probably must file multiple state returns. And if you are a professional athlete playing out of state, you file a state tax return for every state in which you play.

Tax-Preparation Costs Vary by Region

Tax preparation costs vary by location. According to accounting software provider Canopy, the average cost for an itemized 1040 and state return (when applicable) ranges from $158 in North Dakota to $483 in Hawaii. The average fee for an itemized return in the U.S. is $302, while a non-itemized return averages $221.

Taxpayers in larger towns generally pay more than those in smaller towns, according to a fee study by the National Association of Tax Professionals (NATP).

Average minimum fees vary by town size (from $117 in communities with fewer than 10,000 people to $179 in communities with populations over 50,000). And new clients pay about $10 more than returning ones.

If you choose to have a tax accountant, enrolled agent, tax attorney, or CPA prepare your return, you’ll pay, on average, $131 an hour, according to the NATP.

- The average fee for a professional to prepare and submit a Form 1040 with no itemized deductions is $131.

- The average fee for an itemized Form 1040 with Schedule A is $172.

- The average fee for an itemized Form 1040 with Schedule C is $215.

Best Tax-Preparation Software

We looked at costs, features, and customer ratings for free and commercial software and rated them for simple and complex returns. We considered available support, guarantees, ease of use, and the ability to import previous returns.

Best for Free Tax-Prep

While many companies offer free tax prep for basic taxes, there are a few standouts in the free category.

TaxHawk’s free service

Most free products worked only for simple returns eligible for the IRS Free File program. But TaxHawk’s free service covers just about everyone.

Its federal service is free for all returns, and state returns are just $14.95. Their Deluxe edition is only $7.99 and $14.95 for state returns.

Online reviewers love them, giving the company 4.5 stars.

Other free alternatives

For taxpayers with complicated returns who are very confident in their tax-preparation ability and who don’t mind their personal data being collected, CreditKarma’s free online preparation service offers everything needed to complete a filing at zero cost.

The downside is that the actual form is not viewable and filers don’t have access to the real tax forms — just input screens.

Those who want more support and a high-end experience can get it with H&R Block.

It allows filers to import previous years’ returns from other software. It is easy to use and offers more forms than most of its competitors, and it spells out which forms they are.

The product is also one of the few free options, allowing itemized deductions. Block has one important edge over TurboTax — a network of offices staffed by real tax preparers and tax accountants if home filers get stuck.

Best for Simple Returns

For the simplest returns, most taxpayers can find a good solution in the array of free offerings listed in this article.

The only reason to choose a paid option for a simple 1040 return (1040 EZ and 1040A returns were retired by the IRS in 2018) is if the combination of free federal plus paid state option exceeds the cost of a paid federal plus state return.

OLT Online Taxes

OLT Online Taxes is a good bet for those earning more than $66,000 a year. Its full version is just $7.95 and its state tax return costs range from $7.95 to $9.95 as well. However, OLT does not provide a lot of guidance.

TaxACT and Tax Slayer

Taxpayers desiring more help at a low cost should consider TaxACT and Tax Slayer. Both offer a wide range of forms at a bargain price. Both get excellent reviews from users.

H&R Block and TurboTax

Filers who want all the bells and whistles can look to H&R Block and TurboTax. Both providers deliver a smooth interface and get high marks for ease of use. H&R Block’s advantages are lower cost (especially for self-employed filers) and its network of brick-and-mortar offices if customers decide to switch to an in-person experience.

TurboTax’s edge also lies in its many delivery options, from a completely cloud-based preparation to downloadable software (great for those who prepare taxes for more than one person or just prefer to have the program on their own computers) to an actual CD.

Best for Complex Returns

Tax Slayer

Those who know what they are doing and want the lowest price should consider Tax Slayer. The software was originally developed for professional preparers, and its interface is logical.

Many will appreciate the ability to go straight to the forms they want if they want to skip the interview. But they also have the option of the interview format if they want it.

The Classic version covers almost any situation and costs just $17.95. Upgrading to full service with the Premium version gets customers professional help for complex tax situations.

Other complex-return alternatives

Liberty’s eSmartTax gets good reviews (four stars) and its high-end version is $85.95, considerably cheaper than TurboTax. It offers the support of a full-service firm and competes directly with H&R Block. Liberty and eSmartTax software appears to be the same, but eSmartTax is slightly cheaper than Liberty.

Of course, the big names in tax preparation continue to deliver easy-to-use, highly rated, and familiar products with a suite of additional services and support.

H&R Block and TurboTax both have bells and whistles. The choice is really a matter of price and personal preference.

Note that prices for tax software change continuously and deals are common. Look for the best price for each, including promotional offers, including state returns if applicable.

Read the comparison charts on each product’s site before buying. Try to determine the lowest-priced option your situation demands before buying.

One major source of taxpayer pain as detailed in reviews was the frustration of starting with one product only to be forced to upgrade to complete the return. Note what the higher version covers and costs just in case you need it.

Best for Multiple State Returns

For taxpayers who do business or own rentals in many states, the cost of filing multiple state returns can eclipse the cost of their federal return and get very expensive very quickly. However, some products make filing cheaper and less painful.

OLT Online Taxes

OLT Online Taxes charges just $7.95 for its full version (note that it does not provide tax or filing advice), and just $7.95 to $9.95 for state tax returns.

eFile.com

eFile.com received four-star ratings from its users. Its high-end version runs $35.00. And for $29.00, taxpayers can prepare unlimited state returns. Even their free version offers the unlimited-state-return option.

Companies We Surveyed for Tax Year 2022 Tax Software

The table below lists providers, URLs, and costs for each version. Note that the cost includes extra charges for e-filing in some cases, and prices change frequently.

How to Select a Tax Preparer

There are several types of in-person tax preparers who can prepare your return:

Seasonal employees of tax firms have the least amount of training and the lowest cost. Tax accountants, lawyers, and CPAs do provide supervision, and clients can also have them review their returns for an additional fee.

Tax accountants have additional training and usually a four-year degree in accounting or a related field.

Certified Public Accountants (CPAs) have at least a bachelor’s degree in accounting or a related field, log required hours in a public accounting firm, and pass a rigorous set of exams.CPAs can represent clients in Tax Court as well as prepare returns.

Enrolled Agents (EAs) are federally licensed tax practitioners who meet specific education requirements and pass a rigorous set of exams. They can represent clients in Tax Court.

Tax attorneys are licensed lawyers who specialize in tax law. They can help with tax planning, deal with issues like tax liens and garnishments, and represent clients in Tax Court.

More complex situations may require practitioners with extensive training and higher hourly rates. Your cost depends on the practitioner’s hourly rate and the time spent on your return.

Selecting a Tax Preparer

The IRS publishes guidelines for selecting specific tax preparers. These guidelines include:

Check the preparer’s qualifications

Use the IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications. This tool helps taxpayers find a tax return preparer with specific qualifications. The directory is a searchable and sortable listing of preparers.

Check the preparer’s history

Ask the Better Business Bureau about the preparer.

Check for disciplinary actions and the license status of credentialed preparers.

For CPAs, check with the State Board of Accountancy.

For attorneys, check with the State Bar Association. For Enrolled Agents, go to the verify Enrolled-Agent status page on IRS.gov or check the directory.

Ask about service fees

Avoid preparers who base fees on a percentage of the refund or who boast bigger refunds than their competition. When asking about a preparer’s services and fees, don’t give them tax documents, social security numbers, or other information.

Ask to e-file

Taxpayers should make sure their preparer offers IRS e-file. The quickest way for taxpayers to get their refunds is to electronically file their federal tax return and use direct deposit.

Make sure the preparer is available

Taxpayers may want to contact their preparer after this year’s April 15 due date. Avoid fly-by-night preparers.

Provide records and receipts

Good preparers will ask to see a taxpayer’s records and receipts. They’ll ask questions to figure things out like the total income, tax deductions, and credits.

Never sign a blank return

Don’t use a tax preparer who asks a taxpayer to sign a blank tax form.

Review before signing

Before signing a tax return, review it. Ask questions if something is not clear.

Taxpayers should feel comfortable with the accuracy of their return before they sign it.

They should also make sure that their refund goes directly to them – not to the preparer’s bank account. Review the routing and bank account number on the completed return.

The preparer should give you a copy of the completed tax return.

Ensure the preparer signs and includes their PTIN

All paid tax preparers must have a Preparer Tax Identification Number. By law, paid preparers must sign returns and include their PTIN.

Report abusive tax preparers to the IRS

Most tax return preparers are honest and provide great service to their clients.

However, some preparers are dishonest.

Report abusive tax preparers and suspected tax fraud to the IRS. Use Form 14157, Complaint: Tax Return Preparer.

If a taxpayer suspects a tax preparer filed or changed their return without the taxpayer’s consent, they should file Form 14157-A, Return Preparer Fraud or Misconduct Affidavit.

How to Save on Your Tax Bill

Tax planning involves several steps. Employees want to make sure that they withhold enough taxes to avoid under-withholding penalties. Those who wish to owe nothing at tax time or receive a certain refund can adjust their W-4 form to create the result that they desire.

The IRS offers a handy Withholding Estimator taxpayers can use to fill out their W-4 forms.

Investors and business owners must send in estimated taxes either quarterly or monthly, depending on their income. They can use the Estimated Federal Tax Payment System online to do this.

Tax planning also includes paying taxes. Taxpayers who must borrow to pay taxes or set up an installment plan end up paying interest and under-withholding penalties (.5% per month).

So taxpayers who want that interest-free loan from the government but also want to pay their balance by the April 15th filing deadline should put that money where they can earn a return on it but access it easily when needed.

That can be savings accounts, short-term CDs (or as part of a laddered CD plan), mutual funds (check the fine print for fees and penalties), and other liquid investments.

For complex situations, a CPA, EA, or tax attorney may be able to help trim a tax bill. Finding tax-advantaged investments, the best way to set up a business, or the smartest way to time and classify expenses are all parts of tax planning for lower bills in the future.

What to Do With Your Tax Refund

Those lucky enough to get a tax refund have many options for spending or saving it. Here are some other options for what to do with any excess amounts:

- Increase emergency savings. Experts recommend two to six months of living expenses, depending on the reliability of income.)

- Pay down high-interest debt. This is a good strategy that can cut interest costs now and reduce future borrowing costs by increasing FICO scores.

- Put it toward next year’s taxes. This may be a good strategy if you owed too much in 2019 and want to head off an under-withholding penalty.

- Invest for retirement.

- Pay for home improvements or repairs.

Tax time isn’t fun for anyone except possibly tax professionals. But with the right planning and product, most taxpayers can survive the season with minimal pain.